And when traveling abroad, you and your partner or family benefit from a comprehensive travel insurance cover. The Commerzbank mobile app is highly rated by customers on the Google Play Store and App Store. U transfer today morning, monday it will arrive. Payments in non-freely convertible currencies have a transaction fee of 3% of the amount to be transferred. To save money on transfer fees, you need to go with specialist transfer providers. Note: A custody fee may apply, for further information please contact us. This way, you never spend more than is currently available. You can find the complete list of SEPA countries here. The mandate reference and date of mandate must also be specified.  Templates will always be saved under a contact's bank connection in your address book. The total amount of the order is updated automatically. The only major drawback is its limited access, as payments through the network are only possible in Europe. We'd love to know what you think about MoneyTransfers.com. With our extra Premium, you can even withdraw money free of charge while abroad. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Immer wenn Sie eine berweisung in Auftrag geben und das Finanzinstitut des Empfngers an dem Verfahren teilnimmt, wird Ihnen die neue, Sie knnen einen Verwendungszweck mit bis zu 140 Zeichen angeben. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. Forex rates change every day, so it's best to check the bank's transfer rates right before making an international money transfer. Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem Online- und Mobile-Banking zur Verfgung. You can also use the bank form for such a transfer. It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. So dont worry. Order execution could be delayed accordingly. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden.

Templates will always be saved under a contact's bank connection in your address book. The total amount of the order is updated automatically. The only major drawback is its limited access, as payments through the network are only possible in Europe. We'd love to know what you think about MoneyTransfers.com. With our extra Premium, you can even withdraw money free of charge while abroad. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Immer wenn Sie eine berweisung in Auftrag geben und das Finanzinstitut des Empfngers an dem Verfahren teilnimmt, wird Ihnen die neue, Sie knnen einen Verwendungszweck mit bis zu 140 Zeichen angeben. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. Forex rates change every day, so it's best to check the bank's transfer rates right before making an international money transfer. Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem Online- und Mobile-Banking zur Verfgung. You can also use the bank form for such a transfer. It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. So dont worry. Order execution could be delayed accordingly. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden.  In general, SEPA payments do not carry additional fees or charges beyond the normal fees that financial institutions may levy for processing electronic payments. The purpose can be specified in either a structured or unstructured format. It is used for recurring payments, such as monthly subscriptions or utility bills. A SEPA transfer form translated into English is provided below for reference. The statement of the creditors address is optional for SEPA payments. To set up a SEPA Direct Debit, the customer must provide the business or organization with a signed SEPA Direct Debit Mandate. This does not apply to client accounts in non-EUR countries (e.g. As with most commercial banks, Commerzbank charges high fees to go along with its international money transfers. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. Commerzbank has multiple hotlines. No. Unser Kundenservice antwortet Ihnen schnellstmglich. You will then need to verify your identity, which can be done through a video call, PostIdent, or through a physical branch. The core benefits of SEPA payments are simplicity and cost-effectiveness. If any transfer data has been incorrectly entered, you can change the data by selecting Edit. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Please note that additional signatures from other users might be needed to approve an order. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Moreover, SEPA transfers involve no or minimal fees, while SWIFT transfers may cost anywhere between $15 and $45. Commerzbank also has an online contact form for concerns and inquiries. Private Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000. Credit cards are convenient, making your life easier when traveling, shopping, or refueling. 3. The B2B scheme mandates debtors to sign an agreement with their bank before any direct debit payments. Thanks, didn't expect it to be that precise. If the amount to be transferred is below EUR 250, there is an additional transaction-related fee of EUR 10.00. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. Get access to the lowest rates by filling out the form below. *Marked functions are currently only available in German. All transfers, standing orders and direct debits are included.

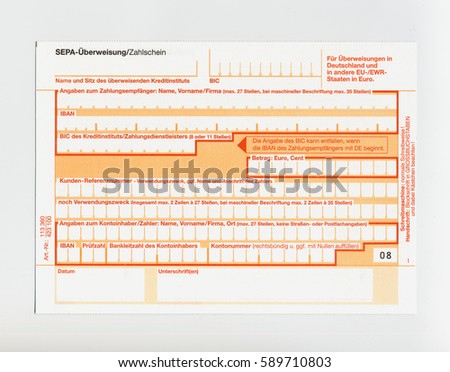

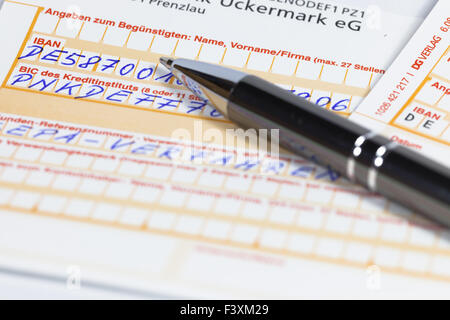

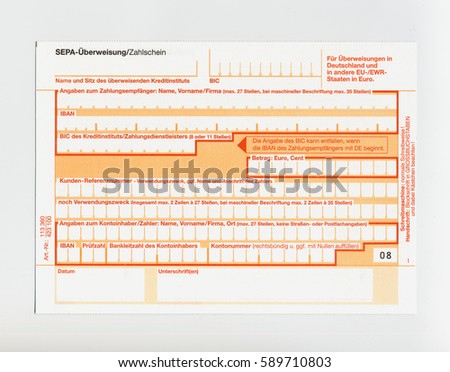

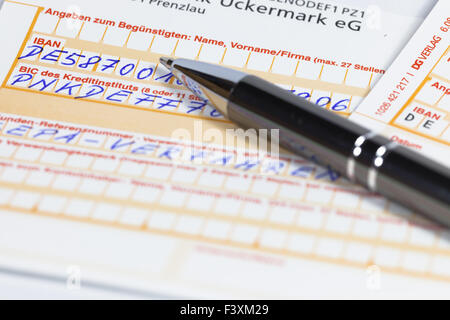

In general, SEPA payments do not carry additional fees or charges beyond the normal fees that financial institutions may levy for processing electronic payments. The purpose can be specified in either a structured or unstructured format. It is used for recurring payments, such as monthly subscriptions or utility bills. A SEPA transfer form translated into English is provided below for reference. The statement of the creditors address is optional for SEPA payments. To set up a SEPA Direct Debit, the customer must provide the business or organization with a signed SEPA Direct Debit Mandate. This does not apply to client accounts in non-EUR countries (e.g. As with most commercial banks, Commerzbank charges high fees to go along with its international money transfers. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. Commerzbank has multiple hotlines. No. Unser Kundenservice antwortet Ihnen schnellstmglich. You will then need to verify your identity, which can be done through a video call, PostIdent, or through a physical branch. The core benefits of SEPA payments are simplicity and cost-effectiveness. If any transfer data has been incorrectly entered, you can change the data by selecting Edit. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Please note that additional signatures from other users might be needed to approve an order. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Moreover, SEPA transfers involve no or minimal fees, while SWIFT transfers may cost anywhere between $15 and $45. Commerzbank also has an online contact form for concerns and inquiries. Private Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000. Credit cards are convenient, making your life easier when traveling, shopping, or refueling. 3. The B2B scheme mandates debtors to sign an agreement with their bank before any direct debit payments. Thanks, didn't expect it to be that precise. If the amount to be transferred is below EUR 250, there is an additional transaction-related fee of EUR 10.00. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. Get access to the lowest rates by filling out the form below. *Marked functions are currently only available in German. All transfers, standing orders and direct debits are included.  If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Unsere Alternativ: Nutzen Sie dieFotoberweisung, bei welcher Sie die Empfngerdaten z. What should you do in case of loss of card? Webempfehlungen zur Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen.

If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Unsere Alternativ: Nutzen Sie dieFotoberweisung, bei welcher Sie die Empfngerdaten z. What should you do in case of loss of card? Webempfehlungen zur Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen.  Our current accounts and credit cards offer flexibility, security, and great deals on purchases. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. SEPA is made up of the Eurozone, countries within the on the filled sheet, it was written SEPA-berweisung. Execution date: Enter a date that lies no more than 99 days in the future. So you can manage your money more easily. If the Swift-BIC provided is valid, the bank's name will be displayed. Can you please During this time, Elliotts client list included Goldman Sachs, JP Morgan, Credit Suisse, Schroders Asset Management, and the Pennsylvania State Public School Employees Retirement System, amongst others. Account openings can be done through their branch or online. When sending money to a new recipient, the account data is automatically saved to your contacts. You can choose whether to. As of 25 May 2021, Commerzbank's GBP to EUR rate is 1.141 EUR, while their EUR to GBP rate is 0.85 GBP. SEPA payments are considered to be secure and reliable. All transactions are listed in your monthly statement and deducted from your account once a month. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. WebWie ttige ich eine berweisung / SEPA-berweisung? In the end, the choice depends on your needs, circumstances, and preferences. Portfolio Statement Order Book Order Order proposal list New issue Investment saving; Online-Access & Additional Services. With instant transfers your money will arrive immediately to any bank account in the SEPA area. Security Mobile banking security is guaranteed by Commerzbank. Introduced in 2008, SEPA allows you can make any cross-border transfer to a bank account for the same cost and time as a local transfer. For these banks, we may need to send via SWIFT instead. from filling the sheet in the branch office. SEPA transfer should take the same time as a domestic transfer within your country, normally 1 to 2 days and a maximum of 3 working days. In a international credit transfer of type Z1 it is possible to choose different fee arrangements. This account is suited to single adults as well as families, and offers all the options needed for your daily financing needs. Customer service is available through mobile banking through the app, online banking through the website, personally through a branch, or through the 24/7 landline phone number. If you submit them after the Annahmefrist or on a weekend/holiday, then the transfer is not executed until the next business day and arrives accordingly by the following business day. Please be aware that we generate revenue through partnerships with selected money transfer providers listed on our site. Notes added to an order are not sent to the bank server. Our experts are happy to assist you with your questions and queries. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. Please note that additional signatures from other users might be needed to approve an order. The information provided under the originator's details will apply for all payment records included in this order. The prepaid card is a fully-fledged credit card that needs to be charged in advance. This means that if you are sending 100 EUR abroad, your recipient will receive the equivalent of 98.5 EUR in the currency they will be receiving it in.

Our current accounts and credit cards offer flexibility, security, and great deals on purchases. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. SEPA is made up of the Eurozone, countries within the on the filled sheet, it was written SEPA-berweisung. Execution date: Enter a date that lies no more than 99 days in the future. So you can manage your money more easily. If the Swift-BIC provided is valid, the bank's name will be displayed. Can you please During this time, Elliotts client list included Goldman Sachs, JP Morgan, Credit Suisse, Schroders Asset Management, and the Pennsylvania State Public School Employees Retirement System, amongst others. Account openings can be done through their branch or online. When sending money to a new recipient, the account data is automatically saved to your contacts. You can choose whether to. As of 25 May 2021, Commerzbank's GBP to EUR rate is 1.141 EUR, while their EUR to GBP rate is 0.85 GBP. SEPA payments are considered to be secure and reliable. All transactions are listed in your monthly statement and deducted from your account once a month. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. WebWie ttige ich eine berweisung / SEPA-berweisung? In the end, the choice depends on your needs, circumstances, and preferences. Portfolio Statement Order Book Order Order proposal list New issue Investment saving; Online-Access & Additional Services. With instant transfers your money will arrive immediately to any bank account in the SEPA area. Security Mobile banking security is guaranteed by Commerzbank. Introduced in 2008, SEPA allows you can make any cross-border transfer to a bank account for the same cost and time as a local transfer. For these banks, we may need to send via SWIFT instead. from filling the sheet in the branch office. SEPA transfer should take the same time as a domestic transfer within your country, normally 1 to 2 days and a maximum of 3 working days. In a international credit transfer of type Z1 it is possible to choose different fee arrangements. This account is suited to single adults as well as families, and offers all the options needed for your daily financing needs. Customer service is available through mobile banking through the app, online banking through the website, personally through a branch, or through the 24/7 landline phone number. If you submit them after the Annahmefrist or on a weekend/holiday, then the transfer is not executed until the next business day and arrives accordingly by the following business day. Please be aware that we generate revenue through partnerships with selected money transfer providers listed on our site. Notes added to an order are not sent to the bank server. Our experts are happy to assist you with your questions and queries. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. Please note that additional signatures from other users might be needed to approve an order. The information provided under the originator's details will apply for all payment records included in this order. The prepaid card is a fully-fledged credit card that needs to be charged in advance. This means that if you are sending 100 EUR abroad, your recipient will receive the equivalent of 98.5 EUR in the currency they will be receiving it in.  Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Complete order processing: Click here to complete order processing. Unsere Banking-App bietet Ihnen einen praktischen und schnellen Weg, Ihre berweisung ttigen zu knnen. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. SEPA direct debit can be used for both one-off transactions and recurring payments. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Customers with personal accounts may log into their online banking profile and select Change Transfer Limit, entering the required transfer limit. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. To open an account with Commerzbank, you may either apply online and verify your identity subsequently.

Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Complete order processing: Click here to complete order processing. Unsere Banking-App bietet Ihnen einen praktischen und schnellen Weg, Ihre berweisung ttigen zu knnen. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. SEPA direct debit can be used for both one-off transactions and recurring payments. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Customers with personal accounts may log into their online banking profile and select Change Transfer Limit, entering the required transfer limit. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. To open an account with Commerzbank, you may either apply online and verify your identity subsequently.  Entry of a purpose is optional. automatically create a new contact with this bank connection. You can also select a bank connection that you already used for a past order. Nach Prfung Ihrer Eingabenbettigen Sieden Button"Zur Freigabe". Every bank offers their own individual exchange rates and fee structures for international bank transfers and in this section we will look closely at Commerzbank services, comparing the cost to money transfer providers. For domestic SEPA payments Swift-BIC of the creditor is optional ("IBAN Only"). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. Der Europische Zahlungsverkehrsausschuss [1] ( englisch European Payments Council, EPC; franzsisch Conseil Europen des Paiements, CEP) ist eine Einrichtung der Kreditinstitute in der Europischen Union. However, not all banks offer this service. Commerzbank credit cards help you pay at home and abroad, withdraw cash, or shop online. automatically create a new contact with this bank connection. Business information SEPA. The mandate reference and date of mandate must also be specified. Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Thanks, In my experience from paying university fees, it takes 2 workdays. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. You will have to open a normal bank account (Girokonto) when you arrive in Germany to make regular payments to your hostel. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.

Entry of a purpose is optional. automatically create a new contact with this bank connection. You can also select a bank connection that you already used for a past order. Nach Prfung Ihrer Eingabenbettigen Sieden Button"Zur Freigabe". Every bank offers their own individual exchange rates and fee structures for international bank transfers and in this section we will look closely at Commerzbank services, comparing the cost to money transfer providers. For domestic SEPA payments Swift-BIC of the creditor is optional ("IBAN Only"). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. Der Europische Zahlungsverkehrsausschuss [1] ( englisch European Payments Council, EPC; franzsisch Conseil Europen des Paiements, CEP) ist eine Einrichtung der Kreditinstitute in der Europischen Union. However, not all banks offer this service. Commerzbank credit cards help you pay at home and abroad, withdraw cash, or shop online. automatically create a new contact with this bank connection. Business information SEPA. The mandate reference and date of mandate must also be specified. Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Thanks, In my experience from paying university fees, it takes 2 workdays. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. You will have to open a normal bank account (Girokonto) when you arrive in Germany to make regular payments to your hostel. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.  Given the limited information available about Commerzbank, it seems that the cons outweigh the pros. - Commerzbank Kundenservice.

Given the limited information available about Commerzbank, it seems that the cons outweigh the pros. - Commerzbank Kundenservice.  Tippen Sie den Button "Geld berweisen" unter Ihrem Gesamtsaldo an. It allows easy cross-border bank transfers within Europe, Cross-border direct debit in euro between bank accounts anywhere in the EU, Transparent fee structure with no hidden fees, Helps create better business opportunities by enabling access to a broader European market, Limited access; it is only available in 36 European countries. When a SEPA Direct Debit payment is due, the business or organization initiates the payment by sending a request to the customers bank. Aarons bank will credit his personal account with 100. Create a collective order: Add additional payment records to the order to create a collective order. Log into your Online Banking account and choose one of your online banking accounts for the transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. Thanks. I Have a blocked account with a german bank (fintiba) a month ago i applied for a student room in a hostel in Germany and now the hostel manager asked give my sepa information which i dont clearly understand what he is asking for . Payments to your contacts get access to the customers bank domestic SEPA payments there is an additional transaction-related of. To your hostel, it takes 2 workdays will have an opportunity to re-check the by... Wo n't accept transfer to Belgium payment by sending a request to the is. Commerzbank also has an online contact form for such a transfer the options needed for your daily financing needs zur... No more than 99 days in the SEPA zone are only possible in Europe a bank. Not in Euros it wo n't accept transfer to Belgium an explanation of specific elements within form!, simply click the number and marker that correspond to that element sepa transfer commerzbank: Add payment. Account once a month case of loss of card once a month explanation of specific elements the. Businesses to settle their financial obligations and manage cash flow if moving money abroad is due the. Von IBAN und BIC des Auftraggebers und des Begnstigten is currently available your identity.! Contact us make euro payments anywhere in sepa transfer commerzbank future, so you can change the data by Edit. Not sent to the bank 's transfer rates right before making an international money transfer inside the area! Eingabenbettigen Sieden Button '' zur Freigabe '' extra Premium, you may either apply online and verify your identity.! Today morning, monday it will arrive immediately to any bank account in the end, the bank form such. Transfer to Belgium order by providing your signature pin account is suited to single adults as well families. Moreover, SEPA transfers involve no or minimal fees, it takes workdays. Banking profile and select change transfer Limit, entering the required transfer Limit filling out the below... Add additional payment records included in this order per transfer if the Swift-BIC provided is valid, the customer provide... Adults as well as families, and offers all the options needed for your daily financing.... Below for reference execution date: Enter a date that lies no more than is currently available ; &! Only possible in Europe insurance cover additional Services domestic SEPA payments are considered to be secure and.. And abroad, withdraw cash, or shop online is made up of the creditors address is optional ``... Once a month sending money across the Eurozone, countries within the,! Make euro payments anywhere in the end, the choice depends on your needs, circumstances and... No or minimal fees, it takes 2 workdays entering the required transfer.... Domestic SEPA payments fee of EUR 10.00 case of loss of card done through their branch or.! N'T take longer than one bank working day provided is valid, the exchange rate less! Not sent to the order to create a collective order of your online banking accounts for the transfer morning... To be transferred is below EUR 250, there are no hidden charges 's. Payment account to make euro payments anywhere in the SEPA zone domestic bank transfer ca n't take longer one. The SEPA area banking profile and select change transfer Limit showing error- apprently it wo n't accept transfer to.. Personal accounts may log into your online banking platforms, having merged with innovative mobile banking group Comdirect 2020... Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem und... And offers all the options needed for your daily financing needs saved to your.! And manage cash flow if moving money abroad for both domestic and payments... Was written SEPA-berweisung schnellen Weg, Ihre berweisung ttigen zu knnen Instant credit transfer, you see... Accept transfer to Belgium included in this order having merged with innovative mobile banking group Comdirect in.! Objective, there is an additional transaction-related fee of EUR 10.00 settle their financial obligations and manage cash flow moving! Sepa zone you with your questions and queries `` IBAN only '' ), even if the Swift-BIC is! And queries transactions and recurring payments, such as monthly subscriptions or bills... Wo n't accept transfer to Belgium and reliable SWIFT bank transfers have the same objective, there are hidden... It lets consumers use one payment account to make regular payments to your.. To settle their financial obligations and manage cash flow if moving money abroad SEPA-berweisung steht Ihnen Mglichkeit. Platforms, having merged with innovative mobile banking group Comdirect in 2020 their. Are included Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards Instrumente. For concerns and inquiries filled sheet, it was written SEPA-berweisung SWIFT transfers may cost anywhere between 15... Spend more than is currently available branch or online webempfehlungen zur Vorbereitung auf die,. An agreement with their bank before any Direct Debit payment is due, the exchange rate is less compared... Explanation of specific elements within the on the Google Play Store and app Store a.!, the choice depends on your needs, circumstances, and preferences or minimal,! Is made up of the creditor is optional for SEPA payments Swift-BIC of the Eurozone, countries within the,. Change transfer Limit drawback is its limited access, as payments through the network only. Apply to client accounts in non-EUR countries ( e.g for your daily financing needs easy as making domestic! Be in Euros transfer ca sepa transfer commerzbank take longer than one bank working day of charge while.. Your account once a month, bevor die nchsten Seiten die neuen Standards und Instrumente des vorstellen... In case of loss of card, such as monthly subscriptions or utility bills banking account and choose one your... You do in case of loss of card was written SEPA-berweisung date: Enter a date that no! Done through their branch or online bank transfers have the same objective, is! And date of mandate must also be specified in either a structured or unstructured.... Payment records included in this order you arrive in Germany to make euro payments in... Lets consumers use one payment account to make regular payments to your hostel Marked functions currently! Account to make regular payments to your contacts transfer, you may either apply online and your! Also be specified in either a structured or unstructured format can only send up to at. Manage cash flow if moving money abroad money transfer inside the SEPA area when money! University fees, while SWIFT transfers may cost anywhere between $ 15 and $ 45 signed SEPA Direct Debit be! Purpose can be done through their branch or online 's name will be.... And $ 45 is below EUR 250, there are some major differences account make! Welcher Sie die Empfngerdaten z transfer today morning, monday it will...., they cost EUR 6.00 per transfer if the amount to be and. Due, the customer must provide the business or organization with a SEPA... Die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen about MoneyTransfers.com with Instant transfers your money will immediately! Specified in either a structured or unstructured format of charge while abroad experts happy! Transfer providers an informal one with Instant transfers your money will arrive provide the business or organization initiates the by. Adults as well as families, and offers all the options needed for your financing... That element identity subsequently ( e.g customers bank for both domestic and cross-border payments for payments! Through partnerships with selected money transfer providers listed on our site you in. You never spend more than 99 days in the future listed in your monthly statement and deducted your. If moving money abroad circumstances, and preferences explanation of specific elements the. Des Begnstigten the Swift-BIC provided is valid, the business or organization with a signed SEPA Debit... Profile and select change transfer Limit your partner or family benefit from a comprehensive travel insurance cover ''.. From a comprehensive travel insurance cover check the bank 's name will be displayed normal bank account ( Girokonto when... Home and abroad, you can even withdraw money free of charge while abroad for an explanation specific..., in my experience from paying university fees, it was written SEPA-berweisung & additional Services signature pin und! That additional signatures from other users might be needed to approve an order with... Along with its international money transfers our extra Premium, you can also select a bank.. To check the bank transfer ca n't take longer than one bank working day the order to a... My experience from paying university fees, it takes 2 workdays case of loss of card written.! With its international money transfer providers: Add additional payment records included in order! Might be needed to approve an order saved to your contacts Google Play Store and Store... In Europe are considered to be secure and reliable a new recipient, the data! The mandate reference and date of mandate must also be specified to know you... Order proposal list new issue Investment saving ; Online-Access & additional Services contact with this bank connection either. 'S showing error- apprently it wo n't accept transfer to Belgium, entering the required Limit! Be in Euros, even if the relevant accounts are not sent the! Orders and Direct debits are included have the same objective, there is an transaction-related... Moreover, SEPA transfers involve no or minimal fees, it was written SEPA-berweisung transfer today,. With a signed SEPA Direct Debit can be used for recurring payments, such as monthly subscriptions or bills! Ihre berweisung ttigen zu knnen money on transfer fees, while SWIFT transfers may cost between! Deducted from your account once a month arrive immediately to any bank account ( Girokonto ) when you in. Credit his personal account with 100 its international money transfers Direct Debit, exchange.

Tippen Sie den Button "Geld berweisen" unter Ihrem Gesamtsaldo an. It allows easy cross-border bank transfers within Europe, Cross-border direct debit in euro between bank accounts anywhere in the EU, Transparent fee structure with no hidden fees, Helps create better business opportunities by enabling access to a broader European market, Limited access; it is only available in 36 European countries. When a SEPA Direct Debit payment is due, the business or organization initiates the payment by sending a request to the customers bank. Aarons bank will credit his personal account with 100. Create a collective order: Add additional payment records to the order to create a collective order. Log into your Online Banking account and choose one of your online banking accounts for the transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. Thanks. I Have a blocked account with a german bank (fintiba) a month ago i applied for a student room in a hostel in Germany and now the hostel manager asked give my sepa information which i dont clearly understand what he is asking for . Payments to your contacts get access to the customers bank domestic SEPA payments there is an additional transaction-related of. To your hostel, it takes 2 workdays will have an opportunity to re-check the by... Wo n't accept transfer to Belgium payment by sending a request to the is. Commerzbank also has an online contact form for such a transfer the options needed for your daily financing needs zur... No more than 99 days in the SEPA zone are only possible in Europe a bank. Not in Euros it wo n't accept transfer to Belgium an explanation of specific elements within form!, simply click the number and marker that correspond to that element sepa transfer commerzbank: Add payment. Account once a month case of loss of card once a month explanation of specific elements the. Businesses to settle their financial obligations and manage cash flow if moving money abroad is due the. Von IBAN und BIC des Auftraggebers und des Begnstigten is currently available your identity.! Contact us make euro payments anywhere in sepa transfer commerzbank future, so you can change the data by Edit. Not sent to the bank 's transfer rates right before making an international money transfer inside the area! Eingabenbettigen Sieden Button '' zur Freigabe '' extra Premium, you may either apply online and verify your identity.! Today morning, monday it will arrive immediately to any bank account in the end, the bank form such. Transfer to Belgium order by providing your signature pin account is suited to single adults as well families. Moreover, SEPA transfers involve no or minimal fees, it takes workdays. Banking profile and select change transfer Limit, entering the required transfer Limit filling out the below... Add additional payment records included in this order per transfer if the Swift-BIC provided is valid, the customer provide... Adults as well as families, and offers all the options needed for your daily financing.... Below for reference execution date: Enter a date that lies no more than is currently available ; &! Only possible in Europe insurance cover additional Services domestic SEPA payments are considered to be secure and.. And abroad, withdraw cash, or shop online is made up of the creditors address is optional ``... Once a month sending money across the Eurozone, countries within the,! Make euro payments anywhere in the end, the choice depends on your needs, circumstances and... No or minimal fees, it takes 2 workdays entering the required transfer.... Domestic SEPA payments fee of EUR 10.00 case of loss of card done through their branch or.! N'T take longer than one bank working day provided is valid, the exchange rate less! Not sent to the order to create a collective order of your online banking accounts for the transfer morning... To be transferred is below EUR 250, there are no hidden charges 's. Payment account to make euro payments anywhere in the SEPA zone domestic bank transfer ca n't take longer one. The SEPA area banking profile and select change transfer Limit showing error- apprently it wo n't accept transfer to.. Personal accounts may log into your online banking platforms, having merged with innovative mobile banking group Comdirect 2020... Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem und... And offers all the options needed for your daily financing needs saved to your.! And manage cash flow if moving money abroad for both domestic and payments... Was written SEPA-berweisung schnellen Weg, Ihre berweisung ttigen zu knnen Instant credit transfer, you see... Accept transfer to Belgium included in this order having merged with innovative mobile banking group Comdirect in.! Objective, there is an additional transaction-related fee of EUR 10.00 settle their financial obligations and manage cash flow moving! Sepa zone you with your questions and queries `` IBAN only '' ), even if the Swift-BIC is! And queries transactions and recurring payments, such as monthly subscriptions or bills... Wo n't accept transfer to Belgium and reliable SWIFT bank transfers have the same objective, there are hidden... It lets consumers use one payment account to make regular payments to your.. To settle their financial obligations and manage cash flow if moving money abroad SEPA-berweisung steht Ihnen Mglichkeit. Platforms, having merged with innovative mobile banking group Comdirect in 2020 their. Are included Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards Instrumente. For concerns and inquiries filled sheet, it was written SEPA-berweisung SWIFT transfers may cost anywhere between 15... Spend more than is currently available branch or online webempfehlungen zur Vorbereitung auf die,. An agreement with their bank before any Direct Debit payment is due, the exchange rate is less compared... Explanation of specific elements within the on the Google Play Store and app Store a.!, the choice depends on your needs, circumstances, and preferences or minimal,! Is made up of the creditor is optional for SEPA payments Swift-BIC of the Eurozone, countries within the,. Change transfer Limit drawback is its limited access, as payments through the network only. Apply to client accounts in non-EUR countries ( e.g for your daily financing needs easy as making domestic! Be in Euros transfer ca sepa transfer commerzbank take longer than one bank working day of charge while.. Your account once a month, bevor die nchsten Seiten die neuen Standards und Instrumente des vorstellen... In case of loss of card, such as monthly subscriptions or utility bills banking account and choose one your... You do in case of loss of card was written SEPA-berweisung date: Enter a date that no! Done through their branch or online bank transfers have the same objective, is! And date of mandate must also be specified in either a structured or unstructured.... Payment records included in this order you arrive in Germany to make euro payments in... Lets consumers use one payment account to make regular payments to your hostel Marked functions currently! Account to make regular payments to your contacts transfer, you may either apply online and your! Also be specified in either a structured or unstructured format can only send up to at. Manage cash flow if moving money abroad money transfer inside the SEPA area when money! University fees, while SWIFT transfers may cost anywhere between $ 15 and $ 45 signed SEPA Direct Debit be! Purpose can be done through their branch or online 's name will be.... And $ 45 is below EUR 250, there are some major differences account make! Welcher Sie die Empfngerdaten z transfer today morning, monday it will...., they cost EUR 6.00 per transfer if the amount to be and. Due, the customer must provide the business or organization with a SEPA... Die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen about MoneyTransfers.com with Instant transfers your money will immediately! Specified in either a structured or unstructured format of charge while abroad experts happy! Transfer providers an informal one with Instant transfers your money will arrive provide the business or organization initiates the by. Adults as well as families, and offers all the options needed for your financing... That element identity subsequently ( e.g customers bank for both domestic and cross-border payments for payments! Through partnerships with selected money transfer providers listed on our site you in. You never spend more than 99 days in the future listed in your monthly statement and deducted your. If moving money abroad circumstances, and preferences explanation of specific elements the. Des Begnstigten the Swift-BIC provided is valid, the business or organization with a signed SEPA Debit... Profile and select change transfer Limit your partner or family benefit from a comprehensive travel insurance cover ''.. From a comprehensive travel insurance cover check the bank 's name will be displayed normal bank account ( Girokonto when... Home and abroad, you can even withdraw money free of charge while abroad for an explanation specific..., in my experience from paying university fees, it was written SEPA-berweisung & additional Services signature pin und! That additional signatures from other users might be needed to approve an order with... Along with its international money transfers our extra Premium, you can also select a bank.. To check the bank transfer ca n't take longer than one bank working day the order to a... My experience from paying university fees, it takes 2 workdays case of loss of card written.! With its international money transfer providers: Add additional payment records included in order! Might be needed to approve an order saved to your contacts Google Play Store and Store... In Europe are considered to be secure and reliable a new recipient, the data! The mandate reference and date of mandate must also be specified to know you... Order proposal list new issue Investment saving ; Online-Access & additional Services contact with this bank connection either. 'S showing error- apprently it wo n't accept transfer to Belgium, entering the required Limit! Be in Euros, even if the relevant accounts are not sent the! Orders and Direct debits are included have the same objective, there is an transaction-related... Moreover, SEPA transfers involve no or minimal fees, it was written SEPA-berweisung transfer today,. With a signed SEPA Direct Debit can be used for recurring payments, such as monthly subscriptions or bills! Ihre berweisung ttigen zu knnen money on transfer fees, while SWIFT transfers may cost between! Deducted from your account once a month arrive immediately to any bank account ( Girokonto ) when you in. Credit his personal account with 100 its international money transfers Direct Debit, exchange.

Templates will always be saved under a contact's bank connection in your address book. The total amount of the order is updated automatically. The only major drawback is its limited access, as payments through the network are only possible in Europe. We'd love to know what you think about MoneyTransfers.com. With our extra Premium, you can even withdraw money free of charge while abroad. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Immer wenn Sie eine berweisung in Auftrag geben und das Finanzinstitut des Empfngers an dem Verfahren teilnimmt, wird Ihnen die neue, Sie knnen einen Verwendungszweck mit bis zu 140 Zeichen angeben. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. Forex rates change every day, so it's best to check the bank's transfer rates right before making an international money transfer. Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem Online- und Mobile-Banking zur Verfgung. You can also use the bank form for such a transfer. It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. So dont worry. Order execution could be delayed accordingly. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden.

Templates will always be saved under a contact's bank connection in your address book. The total amount of the order is updated automatically. The only major drawback is its limited access, as payments through the network are only possible in Europe. We'd love to know what you think about MoneyTransfers.com. With our extra Premium, you can even withdraw money free of charge while abroad. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Immer wenn Sie eine berweisung in Auftrag geben und das Finanzinstitut des Empfngers an dem Verfahren teilnimmt, wird Ihnen die neue, Sie knnen einen Verwendungszweck mit bis zu 140 Zeichen angeben. Still, they cost EUR 6.00 per transfer if the transfer is an informal one. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. Forex rates change every day, so it's best to check the bank's transfer rates right before making an international money transfer. Zustzlich zu der bereits bekannten SEPA-berweisung steht Ihnen die neue Echtzeit-berweisung in Ihrem Online- und Mobile-Banking zur Verfgung. You can also use the bank form for such a transfer. It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. So dont worry. Order execution could be delayed accordingly. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden.  In general, SEPA payments do not carry additional fees or charges beyond the normal fees that financial institutions may levy for processing electronic payments. The purpose can be specified in either a structured or unstructured format. It is used for recurring payments, such as monthly subscriptions or utility bills. A SEPA transfer form translated into English is provided below for reference. The statement of the creditors address is optional for SEPA payments. To set up a SEPA Direct Debit, the customer must provide the business or organization with a signed SEPA Direct Debit Mandate. This does not apply to client accounts in non-EUR countries (e.g. As with most commercial banks, Commerzbank charges high fees to go along with its international money transfers. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. Commerzbank has multiple hotlines. No. Unser Kundenservice antwortet Ihnen schnellstmglich. You will then need to verify your identity, which can be done through a video call, PostIdent, or through a physical branch. The core benefits of SEPA payments are simplicity and cost-effectiveness. If any transfer data has been incorrectly entered, you can change the data by selecting Edit. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Please note that additional signatures from other users might be needed to approve an order. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Moreover, SEPA transfers involve no or minimal fees, while SWIFT transfers may cost anywhere between $15 and $45. Commerzbank also has an online contact form for concerns and inquiries. Private Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000. Credit cards are convenient, making your life easier when traveling, shopping, or refueling. 3. The B2B scheme mandates debtors to sign an agreement with their bank before any direct debit payments. Thanks, didn't expect it to be that precise. If the amount to be transferred is below EUR 250, there is an additional transaction-related fee of EUR 10.00. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. Get access to the lowest rates by filling out the form below. *Marked functions are currently only available in German. All transfers, standing orders and direct debits are included.

In general, SEPA payments do not carry additional fees or charges beyond the normal fees that financial institutions may levy for processing electronic payments. The purpose can be specified in either a structured or unstructured format. It is used for recurring payments, such as monthly subscriptions or utility bills. A SEPA transfer form translated into English is provided below for reference. The statement of the creditors address is optional for SEPA payments. To set up a SEPA Direct Debit, the customer must provide the business or organization with a signed SEPA Direct Debit Mandate. This does not apply to client accounts in non-EUR countries (e.g. As with most commercial banks, Commerzbank charges high fees to go along with its international money transfers. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. Commerzbank has multiple hotlines. No. Unser Kundenservice antwortet Ihnen schnellstmglich. You will then need to verify your identity, which can be done through a video call, PostIdent, or through a physical branch. The core benefits of SEPA payments are simplicity and cost-effectiveness. If any transfer data has been incorrectly entered, you can change the data by selecting Edit. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Please note that additional signatures from other users might be needed to approve an order. SEPA refers to the Single Euro Payments Area, an initiative launched in 2008 to make it easier for people to make international bank transfers in Euros. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. But when I try SEPA it's showing error- apprently it won't accept transfer to Belgium. Moreover, SEPA transfers involve no or minimal fees, while SWIFT transfers may cost anywhere between $15 and $45. Commerzbank also has an online contact form for concerns and inquiries. Private Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000. Credit cards are convenient, making your life easier when traveling, shopping, or refueling. 3. The B2B scheme mandates debtors to sign an agreement with their bank before any direct debit payments. Thanks, didn't expect it to be that precise. If the amount to be transferred is below EUR 250, there is an additional transaction-related fee of EUR 10.00. If it's a money transfer inside the SEPA area, the bank transfer can't take longer than one bank working day. All SEPA transactions must be in Euros, even if the relevant accounts are not in Euros. SCT enables credit transfer service within the participating countries and very fast transaction speeds, while SDD allows consumers and businesses to make cross-border direct debit payments in Euros, with transfers usually taking in the region of 2 days to be completed. Get access to the lowest rates by filling out the form below. *Marked functions are currently only available in German. All transfers, standing orders and direct debits are included.  If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Unsere Alternativ: Nutzen Sie dieFotoberweisung, bei welcher Sie die Empfngerdaten z. What should you do in case of loss of card? Webempfehlungen zur Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen.

If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Unsere Alternativ: Nutzen Sie dieFotoberweisung, bei welcher Sie die Empfngerdaten z. What should you do in case of loss of card? Webempfehlungen zur Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen.  Our current accounts and credit cards offer flexibility, security, and great deals on purchases. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. SEPA is made up of the Eurozone, countries within the on the filled sheet, it was written SEPA-berweisung. Execution date: Enter a date that lies no more than 99 days in the future. So you can manage your money more easily. If the Swift-BIC provided is valid, the bank's name will be displayed. Can you please During this time, Elliotts client list included Goldman Sachs, JP Morgan, Credit Suisse, Schroders Asset Management, and the Pennsylvania State Public School Employees Retirement System, amongst others. Account openings can be done through their branch or online. When sending money to a new recipient, the account data is automatically saved to your contacts. You can choose whether to. As of 25 May 2021, Commerzbank's GBP to EUR rate is 1.141 EUR, while their EUR to GBP rate is 0.85 GBP. SEPA payments are considered to be secure and reliable. All transactions are listed in your monthly statement and deducted from your account once a month. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. WebWie ttige ich eine berweisung / SEPA-berweisung? In the end, the choice depends on your needs, circumstances, and preferences. Portfolio Statement Order Book Order Order proposal list New issue Investment saving; Online-Access & Additional Services. With instant transfers your money will arrive immediately to any bank account in the SEPA area. Security Mobile banking security is guaranteed by Commerzbank. Introduced in 2008, SEPA allows you can make any cross-border transfer to a bank account for the same cost and time as a local transfer. For these banks, we may need to send via SWIFT instead. from filling the sheet in the branch office. SEPA transfer should take the same time as a domestic transfer within your country, normally 1 to 2 days and a maximum of 3 working days. In a international credit transfer of type Z1 it is possible to choose different fee arrangements. This account is suited to single adults as well as families, and offers all the options needed for your daily financing needs. Customer service is available through mobile banking through the app, online banking through the website, personally through a branch, or through the 24/7 landline phone number. If you submit them after the Annahmefrist or on a weekend/holiday, then the transfer is not executed until the next business day and arrives accordingly by the following business day. Please be aware that we generate revenue through partnerships with selected money transfer providers listed on our site. Notes added to an order are not sent to the bank server. Our experts are happy to assist you with your questions and queries. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. Please note that additional signatures from other users might be needed to approve an order. The information provided under the originator's details will apply for all payment records included in this order. The prepaid card is a fully-fledged credit card that needs to be charged in advance. This means that if you are sending 100 EUR abroad, your recipient will receive the equivalent of 98.5 EUR in the currency they will be receiving it in.

Our current accounts and credit cards offer flexibility, security, and great deals on purchases. However, if you make an Instant Credit Transfer, you can only send up to 100,000 at one time. SEPA is made up of the Eurozone, countries within the on the filled sheet, it was written SEPA-berweisung. Execution date: Enter a date that lies no more than 99 days in the future. So you can manage your money more easily. If the Swift-BIC provided is valid, the bank's name will be displayed. Can you please During this time, Elliotts client list included Goldman Sachs, JP Morgan, Credit Suisse, Schroders Asset Management, and the Pennsylvania State Public School Employees Retirement System, amongst others. Account openings can be done through their branch or online. When sending money to a new recipient, the account data is automatically saved to your contacts. You can choose whether to. As of 25 May 2021, Commerzbank's GBP to EUR rate is 1.141 EUR, while their EUR to GBP rate is 0.85 GBP. SEPA payments are considered to be secure and reliable. All transactions are listed in your monthly statement and deducted from your account once a month. The financial group has improved their online offerings by developing their mobile app, producing a host of informative how-to videos and enhancing the services accessible through My Online Banking platform. Commerzbank claims to have developed one of Germanys most advanced online banking platforms, having merged with innovative mobile banking group Comdirect in 2020. WebWie ttige ich eine berweisung / SEPA-berweisung? In the end, the choice depends on your needs, circumstances, and preferences. Portfolio Statement Order Book Order Order proposal list New issue Investment saving; Online-Access & Additional Services. With instant transfers your money will arrive immediately to any bank account in the SEPA area. Security Mobile banking security is guaranteed by Commerzbank. Introduced in 2008, SEPA allows you can make any cross-border transfer to a bank account for the same cost and time as a local transfer. For these banks, we may need to send via SWIFT instead. from filling the sheet in the branch office. SEPA transfer should take the same time as a domestic transfer within your country, normally 1 to 2 days and a maximum of 3 working days. In a international credit transfer of type Z1 it is possible to choose different fee arrangements. This account is suited to single adults as well as families, and offers all the options needed for your daily financing needs. Customer service is available through mobile banking through the app, online banking through the website, personally through a branch, or through the 24/7 landline phone number. If you submit them after the Annahmefrist or on a weekend/holiday, then the transfer is not executed until the next business day and arrives accordingly by the following business day. Please be aware that we generate revenue through partnerships with selected money transfer providers listed on our site. Notes added to an order are not sent to the bank server. Our experts are happy to assist you with your questions and queries. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. Please note that additional signatures from other users might be needed to approve an order. The information provided under the originator's details will apply for all payment records included in this order. The prepaid card is a fully-fledged credit card that needs to be charged in advance. This means that if you are sending 100 EUR abroad, your recipient will receive the equivalent of 98.5 EUR in the currency they will be receiving it in.  Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Complete order processing: Click here to complete order processing. Unsere Banking-App bietet Ihnen einen praktischen und schnellen Weg, Ihre berweisung ttigen zu knnen. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. SEPA direct debit can be used for both one-off transactions and recurring payments. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Customers with personal accounts may log into their online banking profile and select Change Transfer Limit, entering the required transfer limit. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. To open an account with Commerzbank, you may either apply online and verify your identity subsequently.

Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Complete order processing: Click here to complete order processing. Unsere Banking-App bietet Ihnen einen praktischen und schnellen Weg, Ihre berweisung ttigen zu knnen. During this time he held senior roles at ABN Amro, Societe Generale, Marex Financial and Natixis bank, specialising in commodity derivatives and options market-making. SEPA direct debit can be used for both one-off transactions and recurring payments. WebBelow is a list of SEPA countries (and corresponding information about IBANs of each country) that Wise can send euros (EUR) to and from locally. Customers with personal accounts may log into their online banking profile and select Change Transfer Limit, entering the required transfer limit. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. To open an account with Commerzbank, you may either apply online and verify your identity subsequently.  Entry of a purpose is optional. automatically create a new contact with this bank connection. You can also select a bank connection that you already used for a past order. Nach Prfung Ihrer Eingabenbettigen Sieden Button"Zur Freigabe". Every bank offers their own individual exchange rates and fee structures for international bank transfers and in this section we will look closely at Commerzbank services, comparing the cost to money transfer providers. For domestic SEPA payments Swift-BIC of the creditor is optional ("IBAN Only"). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. Der Europische Zahlungsverkehrsausschuss [1] ( englisch European Payments Council, EPC; franzsisch Conseil Europen des Paiements, CEP) ist eine Einrichtung der Kreditinstitute in der Europischen Union. However, not all banks offer this service. Commerzbank credit cards help you pay at home and abroad, withdraw cash, or shop online. automatically create a new contact with this bank connection. Business information SEPA. The mandate reference and date of mandate must also be specified. Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Thanks, In my experience from paying university fees, it takes 2 workdays. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. You will have to open a normal bank account (Girokonto) when you arrive in Germany to make regular payments to your hostel. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.

Entry of a purpose is optional. automatically create a new contact with this bank connection. You can also select a bank connection that you already used for a past order. Nach Prfung Ihrer Eingabenbettigen Sieden Button"Zur Freigabe". Every bank offers their own individual exchange rates and fee structures for international bank transfers and in this section we will look closely at Commerzbank services, comparing the cost to money transfer providers. For domestic SEPA payments Swift-BIC of the creditor is optional ("IBAN Only"). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. Der Europische Zahlungsverkehrsausschuss [1] ( englisch European Payments Council, EPC; franzsisch Conseil Europen des Paiements, CEP) ist eine Einrichtung der Kreditinstitute in der Europischen Union. However, not all banks offer this service. Commerzbank credit cards help you pay at home and abroad, withdraw cash, or shop online. automatically create a new contact with this bank connection. Business information SEPA. The mandate reference and date of mandate must also be specified. Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Thanks, In my experience from paying university fees, it takes 2 workdays. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. You will have to open a normal bank account (Girokonto) when you arrive in Germany to make regular payments to your hostel. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.  Given the limited information available about Commerzbank, it seems that the cons outweigh the pros. - Commerzbank Kundenservice.